Yearly tax calculator

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. Ad Our Resources Can Help You Decide Between Taxable Vs.

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

It can be used for the 201314 to 202122 income years.

. With five working days in a week this means that you are working 40 hours per week. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Philippine Public Finance and Related.

This comes to 102750. We use your income location to estimate your total tax burden. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. All Income tax dates. The tax calculator provides a full step by step breakdown and analysis of each.

Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year. If you make 55000 a year living in the region of New York USA you will be taxed 11959. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

Given that the second. Ad Enter Your Tax Information. This makes your total taxable income amount 27050.

In other places it can be as high as three to four times your monthly mortgage costs. See What Credits and Deductions Apply to You. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

Using the annual income formula the calculation would be. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income. Your average tax rate is.

It will not include any tax credits you may be entitled to for example the. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. The Canada Annual Tax Calculator is updated for the 202223 tax year.

That means that your net pay will be 43041 per year or 3587 per month. Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. That means that your net pay will be 40568 per year or 3381 per month.

In some areas of the country your annual property tax bill may be less than one months mortgage payment. The tax calculator provides a full step by step breakdown and analysis of each. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Annual Income 15hour x 40 hoursweek x. Calculate your 2019 federal state and local taxes with our free income tax calculator. Use Our Free Powerful Software to Estimate Your Taxes.

Discover Helpful Information And Resources On Taxes From AARP.

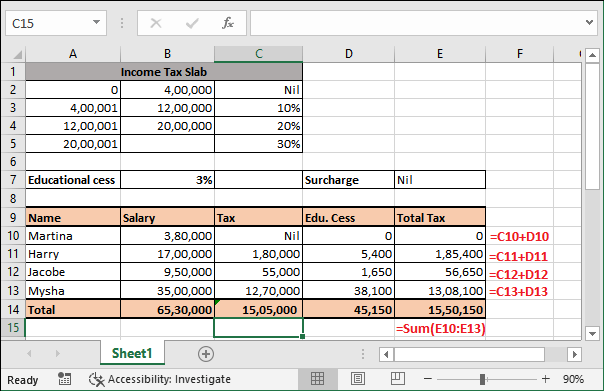

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Property Tax Calculator

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculating Income Tax Payable Youtube

Income Tax Calculating Formula In Excel Javatpoint

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Sales Tax Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel