36+ how much should i spend on mortgage

To calculate how much you can afford with the. Use the 2836 rule as a sign of a.

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

Some experts have suggested something called the 2836 rule.

. Lets say your total. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Get Instantly Matched With Your Ideal Mortgage Lender.

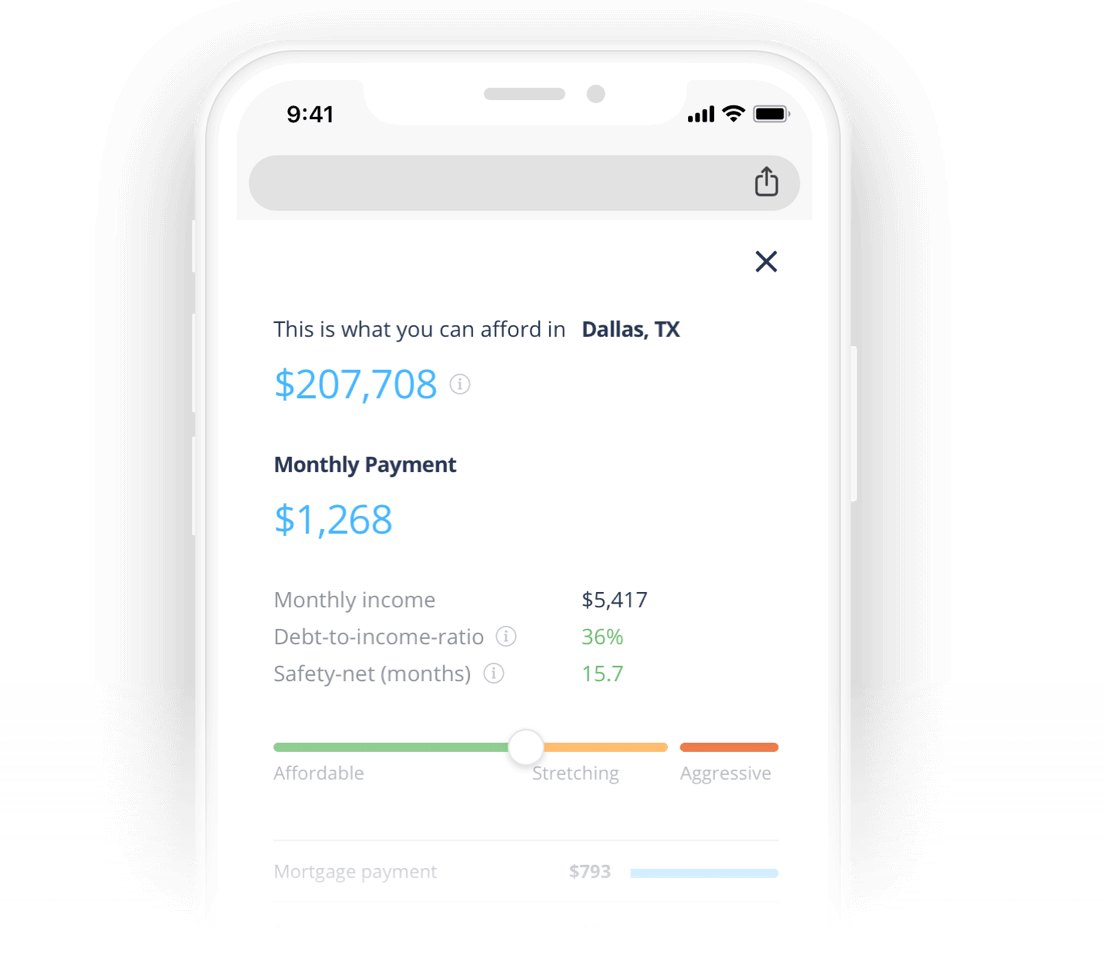

The 28 rule isnt universal. Web I want to show you how our home affordability calculator can help you figure out how much you should spend on a house. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web This model states your total monthly debt should be 25 or less of your post-tax income. Ad More Veterans Than Ever are Buying with 0 Down. Web Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget.

Web According to this rule your mortgage payment shouldnt be more than 28 of your monthly pre-tax income and 36 of your total debt. Web So how much should you spend on monthly repayments. Web We calculated how the 28 rule works out for various incomes.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. This is also known as the debt.

Apply Get Pre-Approved Today. Understand what percentage of. Some financial experts recommend other percentage models like the 3545 model.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Calculate Your Monthly Payment Now. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Get Instantly Matched With Your Ideal Mortgage Lender. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900 per. 8000 35 2800.

Ad Our American Heritage Mortgage Loan Staff Will Help You Purchase Your Home. If you have one of the incomes below heres the maximum you should spend on a house. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Yet the average married couple with children between. Your loan amount would then.

Web To consider how much you can afford in a mortgage payment multiply your comfortable DTI by your gross monthly income. Web If you are purchasing a 300000 home youd pay 35 of 300000 or 10500 as a down payment when you close on your loan. Ad Refinance Your House Today.

Start Your Refinance Online With Americas 1 Online Lender. Web Know how much you should spend on a house before committing yourself to mortgage payments for the next 15 to 30-years. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. Ad Compare the Best Home Loans for February 2023. Web A general guideline is to spend no more than 30 of your income on housing expenses.

This refers to the recommendation that. Lock Your Rate Today. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

Apply Get Pre-Approved Today. Lock Your Rate Today. Ad Compare the Best Home Loans for February 2023.

Estimate Your Monthly Payment Today. This rule says you. Learn About Our Fixed-Rate Mortgage Adjustable-Rate Mortgage Jumbo Mortgage Options.

Lenders may use the 2836 rule which stipulates that housing expenses. Lets say you earn 5000 after taxes. Get Your Free Mortgage Pre-approval Online or Call Our Mortgage Loan Professionals.

Web The 3545 Model.

Proptech Switzerland Innovation Index 2021 By Proptech Switzerland Issuu

Simple Home Affordability Calculator How Much Home Can You Afford

How Much House Can You Afford Down Payment And Mortgage Rates Explained Har Com

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

Free 36 Printable Receipt Forms In Pdf Ms Word

What Is The 28 36 Rule Lexington Law

How Much Of My Income Should Go Towards A Mortgage Payment

What Does The Bride Pay For

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Simple Home Affordability Calculator How Much Home Can You Afford

What Percentage Of Income Should Go To A Mortgage Bankrate

You Want To Pay Someone How Much To Care For Your Child R Choosingbeggars

How To Get A Mortgage Home Loan Tips

Simple Home Affordability Calculator How Much Home Can You Afford

:max_bytes(150000):strip_icc()/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What Percentage Of Your Income To Spend On A Mortgage

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages